In the rapidly evolving landscape of digital assets, an eye-opening insight emerges: launching an Initial Coin Offering (ICO) on a proprietary blockchain dramatically increases the probability of long-term success. Unlike ICOs that piggyback on established networks like Ethereum or Bitcoin, those built on their own dedicated blockchain harness the unseen yet potent force of network effects. This strategic choice can multiply prospects by a staggering six times, turning a speculative venture into a sustainable digital venture. The core advantage lies not just in fundraising ability but in cultivating a resilient ecosystem, which sustains investor confidence and fosters adoption over time.

This revelation challenges conventional wisdom, urging project creators and investors alike to reconsider the importance of technological independence. Proprietary blockchains, when thoughtfully designed, act as fertile ground where a dedicated user base can flourish, thereby magnifying the project’s inherent value. The core lesson is simple yet profound: in the digital economy, network effects are the determining force that can elevate an ICO from a fleeting trend to a transformative asset.

Measuring Success in the Digital Realm

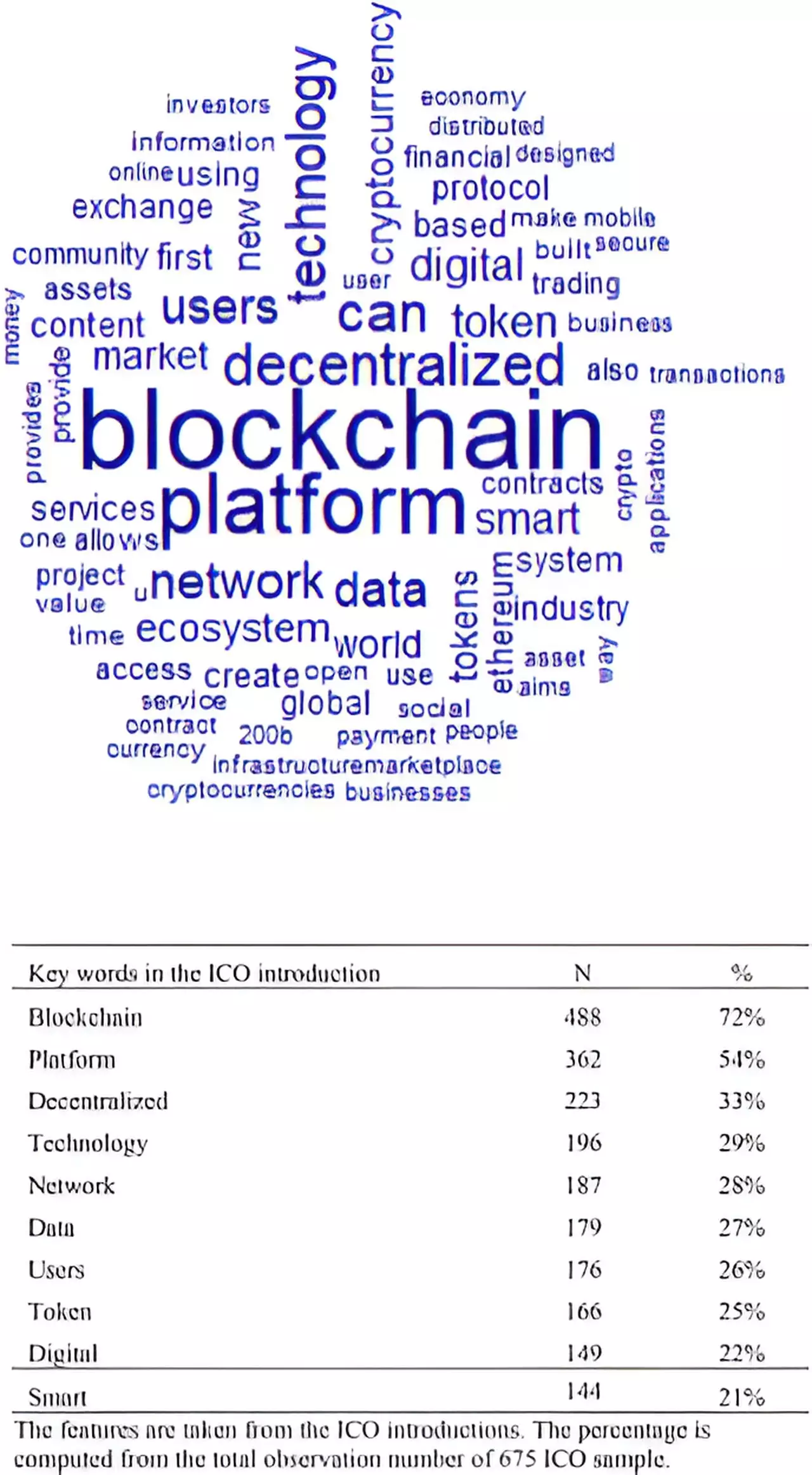

The study introduces an innovative metric, adapted from a modified information ratio designed specifically for evaluating the performance of digital assets relative to established benchmarks like Ethereum and Bitcoin. This tailored approach offers a clearer lens through which to assess the true potential of ICOs, moving beyond raw price increments to understand the strength of their network effects. By analyzing detailed price time series data, the researcher constructs a nuanced picture of how these tokens perform within the context of their ecosystem, giving investors a practical tool to gauge promising opportunities amidst the chaos of the crypto universe.

More than just academic exercise, this metric provides immediate, real-world value. It empowers investors to discriminate effectively between fleeting fads and genuinely promising projects. In a space cluttered with dubious ventures, such a rigorous evaluation method acts as a critical filter, saving time and resources while highlighting ventures poised for sustained growth.

Implications for Entrepreneurs and Investors

The findings reinforce a fundamental principle worth emphasizing: securing initial funding is only the beginning of a project’s journey. Many projects secure impressive sums but falter due to lack of community engagement or ecosystem robustness. Building on a proprietary blockchain not only enhances fundraising prospects but also imbues the project with resilience. When a dedicated user base actively participates in the network, the project’s ecosystem becomes more sustainable, adaptable, and capable of weathering market volatility.

However, the study also serves as a sober reminder: success in fundraising does not automatically translate into project execution. Entrepreneurs must recognize that technological infrastructure alone isn’t enough; cultivating a lively community and delivering meaningful value remain essential. For investors, this emphasizes due diligence, focusing on projects that demonstrate genuine network effects rather than just promising whitepapers. It is this combination of strategic infrastructure choices and community engagement that will define the next generation of successful ICOs in the digital economy.